Logan County Wv Land Taxes

Land Records are maintained by various government offices at the local Logan County West Virginia State and Federal level and they contain a wealth of information about properties and parcels in Logan County. Welcome to the official website of Logan County.

The AcreValue Logan County WV plat map sourced from the Logan County WV tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the.

Logan county wv land taxes. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Logan County. Estimating Real Estate Tax. Select a District and Map Number to view a reduced-size version of the map.

Logan County Land Records are real estate documents that contain information related to property in Logan County West Virginia. Household goods and personal effects not used for commercial purposes. The median property tax on a 7970000 house is 39053 in West Virginia.

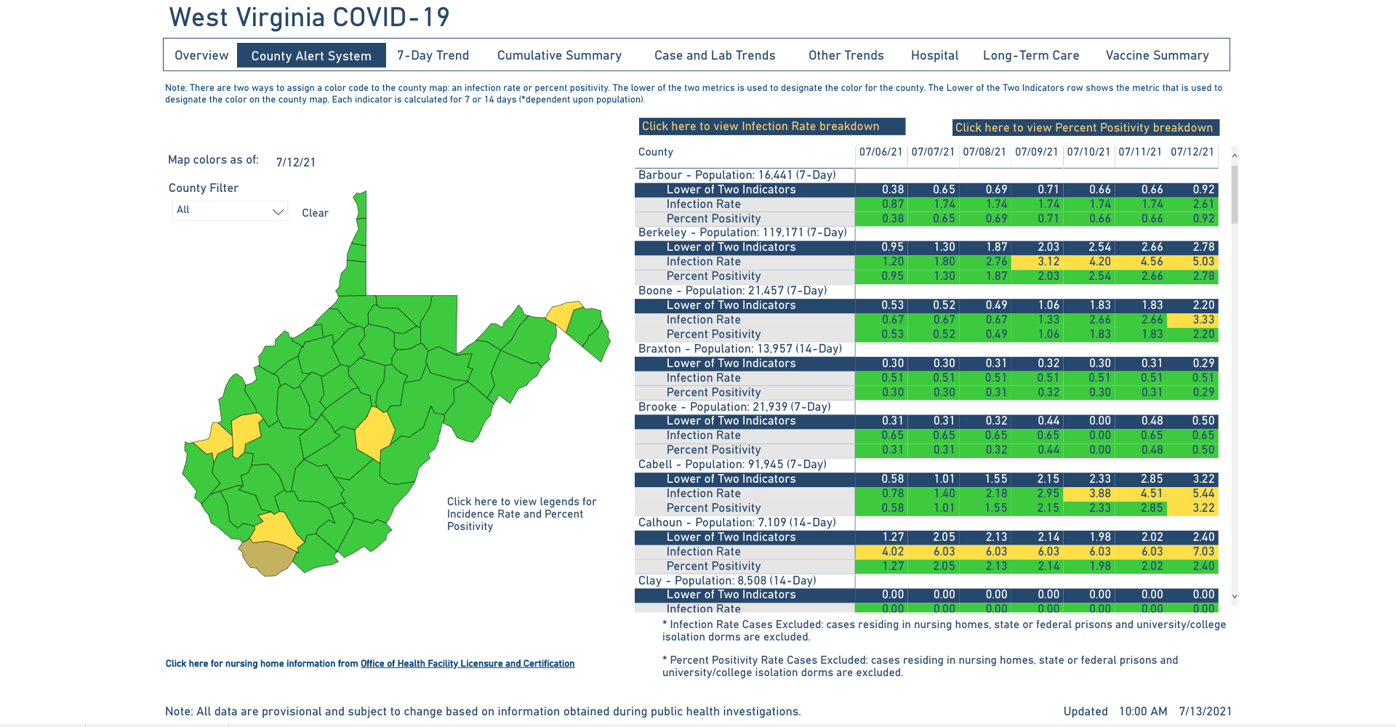

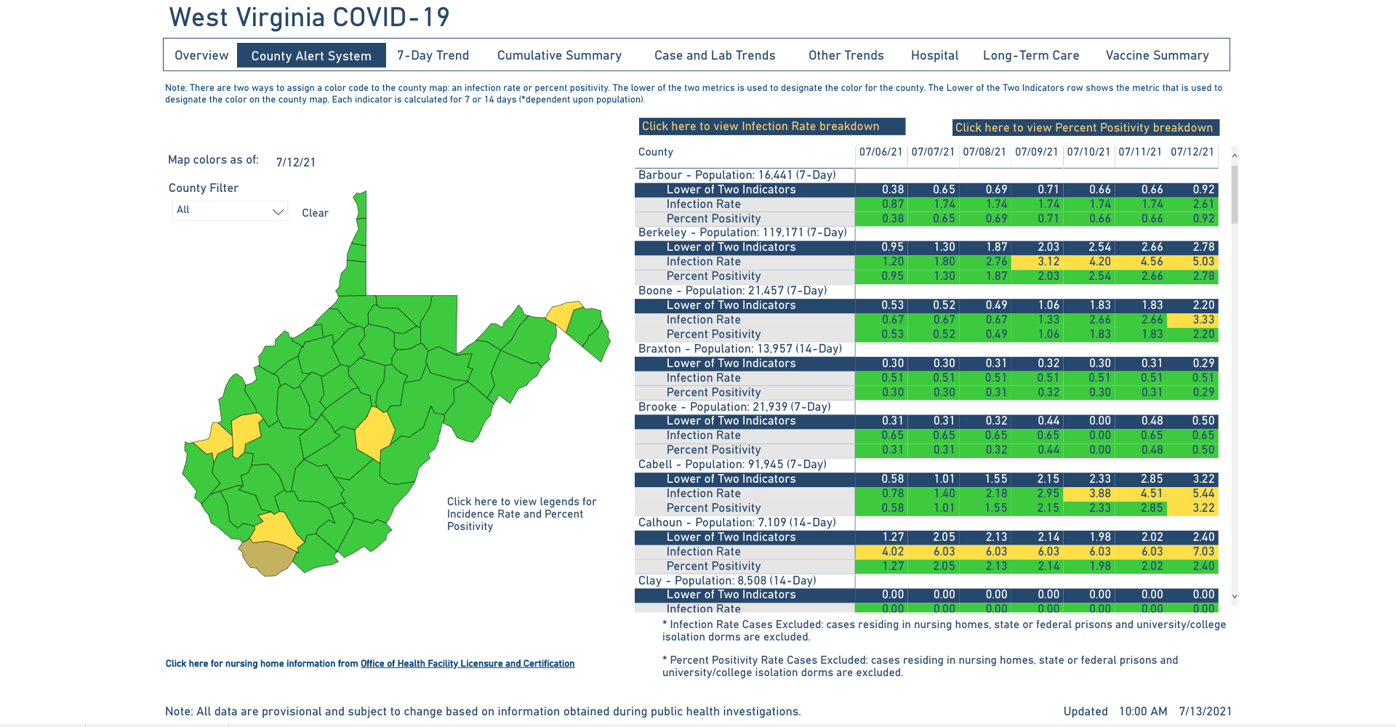

You can use the West Virginia property tax map to the left to compare Logan Countys property tax to other counties in West Virginia. AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Ad Valorem Property Tax All real and tangible personal property with limited exceptions is subject to property tax.

When a Logan County WV tax lien is issued for unpaid past due balances Logan County WV creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. Please take the time to explore our site and let us know how we can better serve our community through this medium. Appraised Value X 60 Assessed Value.

Interested in a tax lien in Logan County WV. Median Property Taxes Mortgage 578. In order to redeem real property purchased by an individual in all counties with the exception of Kanawha and Wood Counties the owner of or any other person who was entitled to pay the taxes shall pay to the State Auditor in certified funds the total amount payable to sheriff and the cost of the Certification of Redemption as well to provide a signed affidavit for redeeming real estate as provide by the West.

The median property tax in Logan County West Virginia is 36600. Logan County is ranked 2640th of the 3143 counties for property taxes as a percentage of median income. These records can include land deeds mortgages land grants and other important property-related documents.

The exact property tax levied depends on the county in West Virginia the property is located in. Prepare cost studies and update land values on an annual basis. This rate includes any state county city and local sales taxes.

The median property tax on a 7970000 house is 83685 in the United States. 2020 rates included for use while preparing your income tax deduction. Full-size maps can be purchased in the Assessors Office.

Below is a representative nonexclusive list of property that may be exempt from property tax. Annually assist the tax commissioner in determining the current use of such real property in hisher county as the tax commissioner may require to accomplish a uniform appraisal and assessment of real property. The first 20000 of assessed value of owner-occupied residential property owned by a person age 65 or older or by a person who is permanently and totally disabled is exempt.

Median Property Taxes No Mortgage 446. The latest sales tax rate for Logan WV. Find property records for Logan County.

The County Treasurer also receives the annual tax roll and abstract prepares the ad valorem tax statements and mails the statements to the property owners. The average yearly property tax paid by Logan County residents amounts to about 089 of their yearly income. This website is intended to provide you with an overview of our countys government and the unique opportunities our county has to offer.

The County Treasurer is responsible for collecting all county ad valorem taxes and may issue delinquent personal and real property tax notices and initiate and supervise tax sales on real. However public service business property is assessed based upon operations as of December 31 each year. As of August 3 Logan County WV shows 10 tax liens.

As of July 1 each year the ownership use and value of property are determined for the next calendar tax year. NWA - NORTHERN LOGAN CO. Jefferson County collects the highest property tax in West Virginia levying an average of 137900 054 of median home value yearly in property taxes while Webster County has the lowest property tax in the state collecting an average tax of.

All of the Logan County information on this page has been verified and checked for accuracy. How does a tax lien sale work. 7 sor The Logan County Assessors office is pleased to make assessment data available online and.

Logan County West Virginia. CT54 - COUNTY TAX D27 - DISTRICT SCHOOL 27 D61 - DISTRICT SCHOOL 61 D88 - NHM SCHOOL DIST D92 - WLBROADWELL DD01 - PRAIRIE CREEK 1 DD02 - PRAIRIE CR SUB 1 DD03 - PRAIRIE CR 2 DD04 - LAKE FORK SPECIAL DD05 - N BRANCH LK FK SP DD06 - N BR LK FK SUB 5 DD07 -. Find the tax assessor for a different West Virginia county.

15 Slow Paced Small Towns In West Virginia Where Life Is Still Simple Towns In West Virginia West Virginia West Virginia Mountains

Historical Facts Of West Virginia Counties

Oceana Wv West Virginia History Wyoming County Appalachia

West Virginia Ranches For Sale Ranchflip

West Virginia Dhhr Reports No New Covid 19 Related Deaths Wv News Wvnews Com

How Healthy Is Logan County West Virginia Us News Healthiest Communities

Publications Maps Amp Services West Virginia Geological And

This Historic Sign Provides Info On My Home County Of Wyoming County Wv I Am A Direct Ancestor Of John Historical Marker West Virginia History Wyoming County

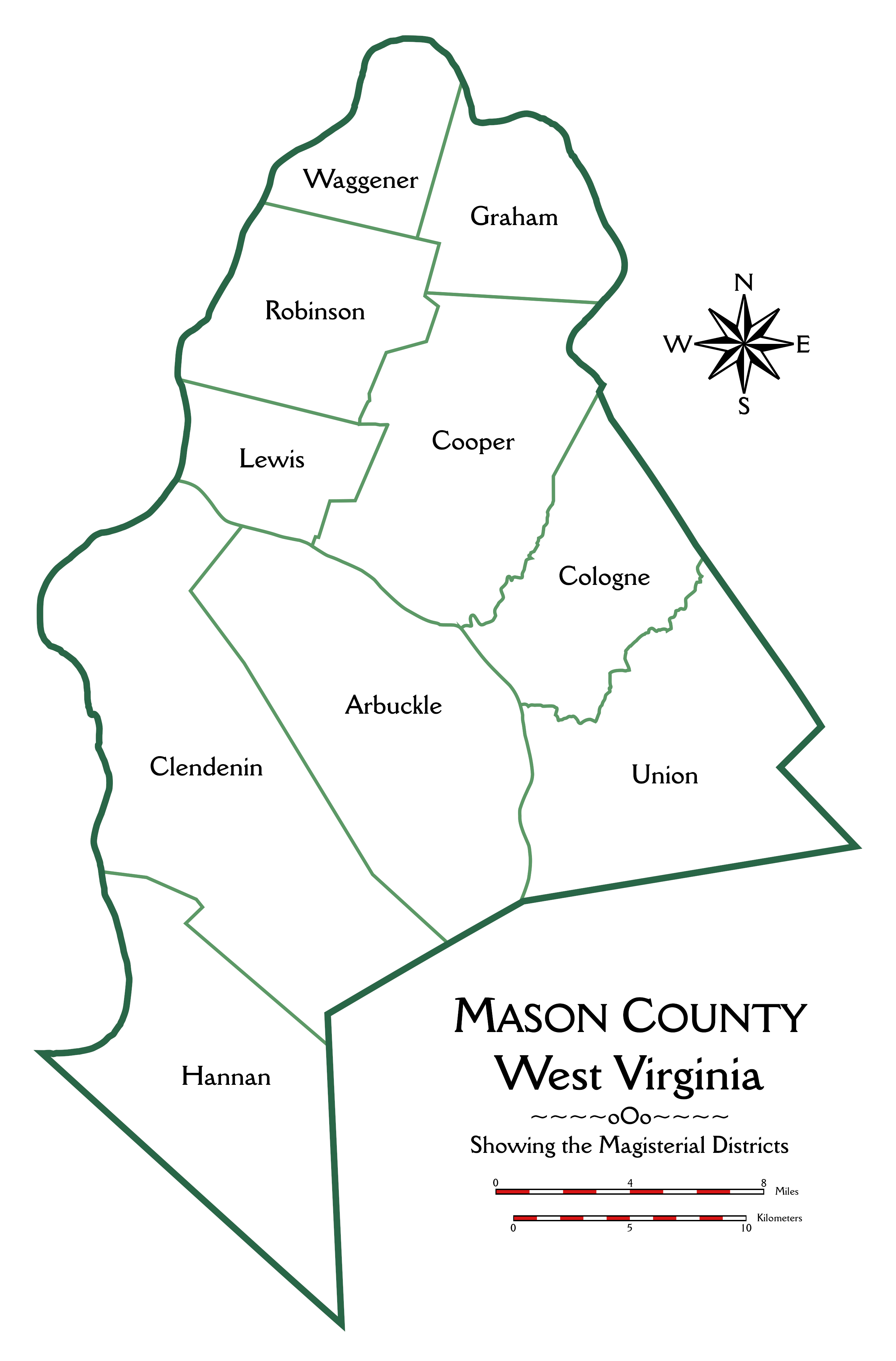

Mason County West Virginia Wikiwand

16122 Acres Logan Wv Property Id 10747442 Land And Farm

72 Acres Bruno Wv Property Id 9825526 Land And Farm

Logan County Wv Land For Sale 6 Listings Landwatch

Post a Comment for "Logan County Wv Land Taxes"